Navigating GBP/USD in 2025

- Site Administrator

- Jul 15, 2025

- 4 min read

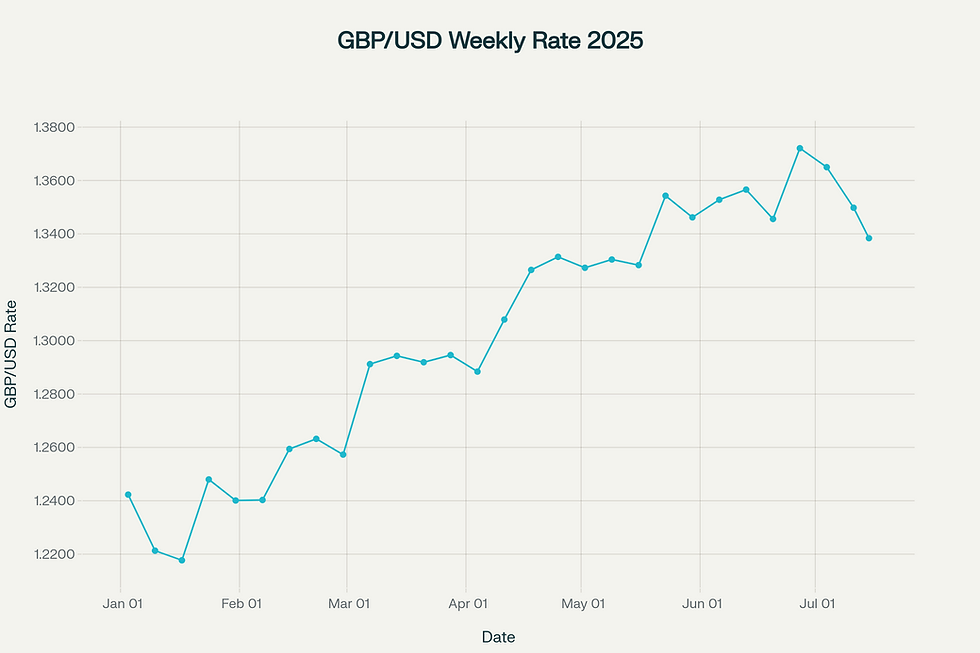

After a challenging 2024, the British Pound has demonstrated remarkable resilience against the US Dollar throughout 2025, delivering a +8.36% year-to-date performance as of July. This strong recovery has seen the pound climb from its 1.25 close at the end of last year to a recent high of 1.378, before settling around 1.34. For expatriates and international investors, understanding this trend is crucial. In this article, we'll break down the key reasons for the pound's resurgence and look at what the major institutions are forecasting for the months ahead.

Key Performance Highlights

Highest Rate: 1.3789 USD reached on July 1, 2025

Lowest Rate: 1.2177 USD on January 17, 2025

Current Rate: 1.3384 USD as of July 15, 2025

Year-to-Date Performance: Up 7.29% in 2025

The Key Drivers Behind Sterling's 2025 Rally

The pound's impressive performance this year isn't random; it's driven by a powerful combination of factors. We can trace the rally to three main forces: a widespread re-evaluation of the US Dollar, renewed stability in neighboring Europe, and the attractive returns offered by UK interest rates.

1. A Cloud of Uncertainty Over the US Dollar

A key driver of the pound's strength has been a significant shift in sentiment around the US Dollar. To begin with, the dollar may have simply gotten ahead of itself in 2024. Its value surged beyond what economic fundamentals could support, creating the conditions for a natural pullback.

This correction was then accelerated by growing policy uncertainty. The Trump administration's anticipated reforms have proven slower and more complex to implement than expected, making global investors nervous. This situation has been significantly amplified by two recent developments:

New Trade Tariffs: The announcement of new tariffs has introduced a major source of global economic risk. This hurts the outlook for US corporate profits and creates uncertainty for international supply chains. In response, many institutions are actively hedging against this risk by reducing their exposure to the US Dollar and seeking safer havens.

A Potentially Overvalued Stock Market: Alongside this, many analysts believe the US stock market is trading at stretched valuations. The risk of a market correction, combined with the economic drag from tariffs, has led many to trim their holdings of US assets in general.

This potent mix of a correcting currency, policy doubt, and new economic risks has prompted a deliberate rebalancing of global capital. As large investors move to protect their portfolios, the British Pound has emerged as a prime beneficiary.

2. A Calmer, More Confident Europe

You can't talk about the UK without talking about Europe. A more stable and optimistic outlook in the European Union has been good news for the pound, given the interconnected nature of the two economies. With the EU taking steps to ensure fiscal stability and political tensions easing, investors are less worried about major economic shocks from the continent. This renewed confidence has a positive knock-on effect for the UK, reducing the perceived risks of investing in British assets and, by extension, supporting Sterling.

3. UK Interest Rates: A Magnet for Investment

At its core, money flows where it is treated best. To combat inflation, the Bank of England has maintained a more aggressive stance on interest rates compared to the US Federal Reserve's more cautious approach. This difference, known as the "interest rate differential," means that large investors can earn a higher return (or "yield") simply by holding their money in pounds rather than dollars. This simple fact increases demand for Sterling from global institutions, providing a powerful and fundamental support for its value.

The Road Ahead: What the Experts are Forecasting

So, where is the pound headed next? To get a sense of the market consensus, we've compiled the latest forecasts from some of the world's leading investment banks. While a broad agreement has formed that the pound's recovery is built on a solid foundation, their year-end targets show different views on just how much further it has to run. It's crucial to note the range of opinions, including more cautious voices, to get a complete picture.

Institution | End-2025 Target | End-2026 Target | 2025 Upside* | 2026 Upside* | Rationale |

Goldman Sachs | 1.44 | 1.44 | +7.2% | +7.2% | US policy uncertainty, European fiscal optimism |

Bank of America | 1.43 | 1.54 | +6.5% | +14.7% | Dollar structural weakness, sterling resilience |

Morgan Stanley | 1.40 | 1.47 | +4.3% | +9.5% | US economic slowdown, rate differentials |

UBS | 1.38 | 1.40 | +2.8% | +4.3% | Dollar weakness, structural factors |

JPMorgan | 1.32 | N/A | -1.7% | N/A | More cautious on sterling strength sustainability |

Synthesizing these institutional views with our own analysis, we at Loadstone Group are maintaining our year-end forecast of 1.43.

While this aligns with the more optimistic targets, our reasoning is rooted specifically in the persistent US policy uncertainty and the compelling interest rate differential, which we believe will continue to drive the rebalancing of institutional capital out of the dollar.

Summary and Outlook

The GBP/USD currency pair's performance in 2025 serves as a clear illustration of how shifting macroeconomic fundamentals can drive sustained currency movements. Sterling's appreciation reflects a confluence of factors, primarily the structural re-evaluation of the US Dollar and the UK’s supportive interest rate differential.

While institutional forecasts suggest continued upside potential, the sustainability of this trend will depend on several key variables. These include the durability of US policy uncertainty, the divergence in monetary policy between the Bank of England and the Federal Reserve, and broader shifts in global risk sentiment.

Ultimately, the pound's recovery story demonstrates the importance of monitoring the interplay between these domestic and international drivers. As we progress through the year, these dynamics will continue to shape the GBP/USD trajectory and determine whether its current strength can be sustained over the longer term.

This report is for informational purposes only and does not constitute investment advice. All data is sourced from institutional research and public market information as of July 15, 2025.

Comments