Mid-Year 2025 Market Review and Outlook

- Site Administrator

- Jul 15, 2025

- 6 min read

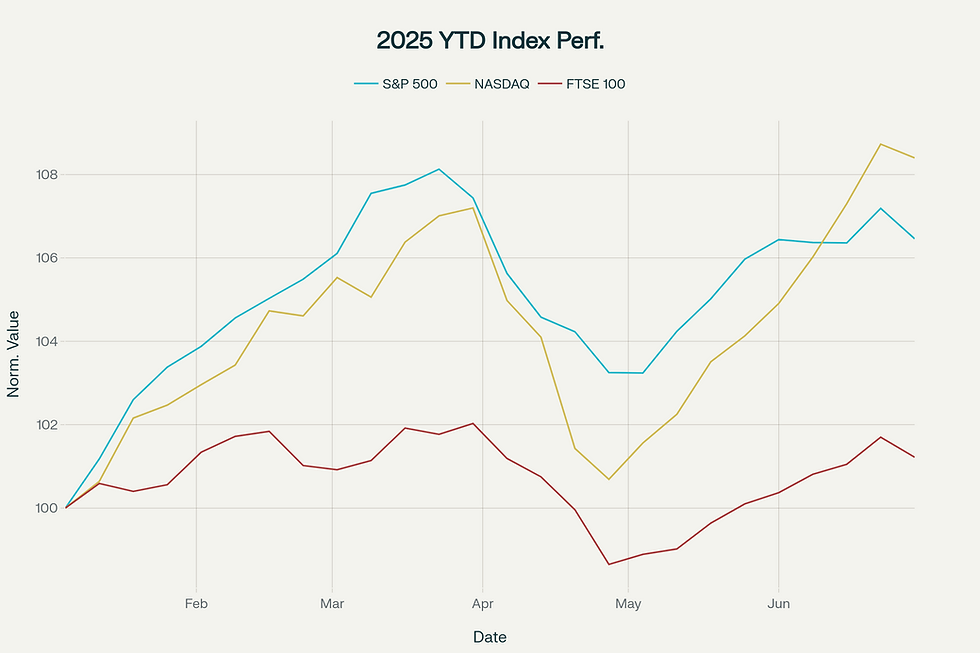

The first half of 2025 presented investors with a complex environment of policy shifts, central bank divergence, and market adaptation. What began as cautious optimism quickly evolved into a test of resilience when comprehensive tariff announcements in April triggered significant corrections across global markets.

Despite substantial turbulence, major equity indices closed the period in positive territory. The defining narrative was the market's reaction to trade policy proposals that threatened to unravel decades of economic integration. Ultimately, policymakers paused implementation, allowing diplomatic negotiations to take precedence and markets to find their footing.

For cross-border investors managing wealth between the UK and US, this period highlighted both the challenges and opportunities inherent in navigating divergent monetary policies and currency movements. Regional performance differences created distinct investment themes that required careful analysis and positioning.

Global Equities: Recovery from the April Stress Test

Global equity markets experienced three distinct phases: initial stability, April's tariff-induced correction, and a subsequent V-shaped recovery. The magnitude of the April decline tested investor conviction, but markets demonstrated their ability to process complex policy information and find new equilibrium levels.

Market Performance Summary

Index | First Half Return | Peak-to-Trough Decline |

S&P 500 | +5.10% | -21.35% |

NASDAQ | +7.38% | -26.52% |

FTSE 100 | +6.96% | -15.31% |

What Drove the April Correction?

The most significant market event occurred in April when new, comprehensive tariff announcements—targeting not only goods but also cross-border data and financial services—triggered sharp sell-offs. The S&P 500 experienced its largest drawdown since 2022, falling over 21% from March highs. Technology stocks faced even steeper declines, with the NASDAQ suffering a 26% correction as investors questioned the impact on global supply chains.

The Recovery Phase

Markets found their footing when policymakers announced a 90-day pause on tariff implementation in late April. This breathing space, combined with resilient corporate earnings and better-than-expected economic data, supported a strong recovery through May and June. The rebound was broad-based, though technology stocks, despite the steepest initial declines, led the recovery.

US Equities: Navigating the Policy Headwinds

US markets faced the most direct impact from policy changes yet still delivered positive returns. The S&P 500's 5.10% gain demonstrated the underlying strength and adaptability of corporate America.

S&P 500: A Story of Resilience: The index's recovery from a 21% drawdown illustrated the durability of large-cap US companies. Its diversification across sectors provided more stability during the volatile April period compared to the tech-heavy NASDAQ.

Corporate Earnings Hold Strong: Corporate earnings emerged as a key support, with companies demonstrating pricing power and operational flexibility that exceeded expectations. The artificial intelligence infrastructure build-out continued to drive capital investment, while robust domestic consumption provided a buffer against external pressures.

The Double-Edged Sword of Tech Leadership: The NASDAQ's 7.38% advance was driven primarily by mega-cap technology stocks, such as Meta Platforms and Netflix. However, its 26% peak-to-trough decline highlighted the concentration risk inherent in growth-oriented portfolios, demonstrating both the volatility and potential rewards of technology investing.

UK Equities: Defensive Characteristics Shine

UK markets delivered solid returns, with the FTSE 100 advancing 6.96%. British equities benefited from several factors that helped insulate them from the worst of the global market stress.

Why the UK Market Was More Defensive: The FTSE 100's relatively modest 15% drawdown highlighted its defensive qualities. This resilience stemmed from the index's sector composition, with significant weightings in stable sectors like banks, utilities, and consumer staples.

Global Revenues and Attractive Valuations: Many FTSE 100 companies have diversified international revenue streams, offering a natural hedge against regional economic weakness. Furthermore, the market's attractive valuations relative to global peers provided additional downside protection.

Bank of England's Hawkish Stance: While the BoE cut rates to 4.25% in May, it subsequently held rates steady in June. This relatively hawkish approach provided support for sterling and UK assets, especially when compared to more aggressive easing cycles elsewhere in Europe.

Beyond the UK/US: Europe's Policy Response

ECB Easing Supports Markets: The European Central Bank continued its supportive stance, reducing its deposit rate to 2.00% by June as inflation returned to its 2% target. This provided a favorable environment for European equities, with the STOXX 600 advancing approximately 8%.

Switzerland’s Dramatic Move to Zero: The most dramatic central bank action came from the Swiss National Bank (SNB), which made an unprecedented move to zero interest rates in June. Faced with an 11% appreciation of the Swiss franc due to safe-haven flows, the SNB acted aggressively to prevent deflation. The central bank explicitly stated that negative rates remained an option, a move Goldman Sachs forecasts by September.

The US Dollar's Dramatic Slide: A Cross-Border Perspective

The US dollar experienced its worst first-half performance since 1973, with the Dollar Index (DXY) falling 10.8% through June. This dramatic decline represented a significant headwind for US-based assets when viewed from abroad.

The currency's performance created a stark reality for cross-border individuals. For a US citizen drawing a dollar-based pension in the UK, purchasing power fell sharply. Conversely, a British professional working in the US found their sterling-denominated savings were suddenly worth much more in dollars. This dramatic shift underscored the necessity of currency-aware financial planning.

For a detailed analysis, see our dedicated report: Currency Outlook: Navigating GBP/USD in 2025.

Fixed Income & Commodities: The Flight to Safety

Fixed Income: The Enduring Value of High-Quality Bonds:

Bond markets experienced significant swings, but ultimately, investors who maintained exposure to high-quality government bonds were rewarded. The flight-to-quality during the April sell-off supported bond prices, reinforcing the value of diversified fixed income allocations.

Commodities: Gold's Exceptional Run:

Gold emerged as the standout performer, delivering over 25% gains and reaching record highs near $3,700 per ounce. Its role as a hedge against policy shifts and currency debasement was validated, with strong demand from investors and central banks alike.

Key Investment Themes from the First Half

Value-Oriented Investing Proved Its Worth. In a challenging environment, value provided better downside protection. According to BlackRock data, US value stocks gained 2% while US growth stocks declined 10%.

Diversification Benefits Were Clear. Companies and assets with diversified global revenue streams and strong balance sheets demonstrated superior resilience during the market correction.

AI Evolved from Infrastructure to Implementation. The investment theme shifted from simply building AI infrastructure to rewarding companies demonstrating tangible revenue and productivity gains from AI adoption.

Central Bank Divergence Created Opportunity. The starkly different monetary policies between the US, UK, ECB, and SNB created clear relative value opportunities for savvy international investors.

Looking Ahead: Navigating the Second Half

As we enter the second half of 2025, policy developments, corporate earnings, and seasonal factors will shape performance.

Policy and Economic Factors: The Federal Reserve's decisions on interest rates remain a critical focus, as do the outcomes of ongoing trade negotiations.

Seasonal Considerations: Summer months traditionally bring increased market fluctuations due to reduced trading volumes. Investors should prepare for continued elevated market movements.

Institutional Forecasts: Major banks have updated their forecasts, reflecting the year's volatility and subsequent recovery.

Institution | January 2025 S&P 500 Target | Current S&P 500 Target | Change |

Goldman Sachs | 6,500 | 6,900 | +400 pts |

JP Morgan | 6,500 | 6,500 | Unchanged |

Bank of America | 5,600 | 6,300 | +700 pts |

Central Bank Policy Expectations

Central Bank | Current Rate | H2 2025 Outlook |

Federal Reserve (US) | 4.50% | Potential cuts to 4.0-4.25% |

Bank of England (UK) | 4.25% | Gradual cuts to 3.75% |

European Central Bank | 2.00% | Further cuts to 1.75% |

Swiss National Bank | 0.00% | Possible move to negative rates (-0.25%) |

Conclusion

The first half of 2025 tested investor resolve but ultimately demonstrated the adaptability of global markets. For cross-border investors, the period was a masterclass in the risks and opportunities of managing wealth across multiple jurisdictions. Currency movements, policy divergence, and regional performance differences created a complex landscape that rewarded careful analysis and disciplined positioning.

As we look toward the second half, we remain constructively positioned while acknowledging that market fluctuations will likely persist. The key to success will be maintaining diversified portfolios, focusing on companies with strong fundamentals, and remaining flexible as conditions evolve.

The events of the first half have reinforced the importance of active management and a long-term strategic vision. The ability to adapt to changing conditions while maintaining focus on long-term objectives will continue to differentiate successful investors from those who struggle with market timing and emotional decision-making.

This analysis is for informational purposes only and should not be considered as investment advice. Past performance does not guarantee future results. Please consult with your financial advisor before making investment decisions.

Comments